🌏 Nvidia’s $8 billion shrug

Plus: Apple’s bite-sized ambitions.

Good morning, Quartz readers!

Suggested Reading

Here’s what you need to know

The trade war’s next phase. As courts continue to rule on President Donald Trump’s tariffs and fresh GDP numbers hit, here’s what to expect over the coming days.

Related Content

Interest in due process. Fed Chair Jerome Powell went to the White House and told Trump that monetary policy is dictated by employment rates and inflation — “by law.”

Maybe the house doesn’t always win. The U.S. housing market has undergone a massive shift: There are now almost 500,000 more home sellers than buyers.

AI’ll be taking that. Anthropic’s CEO says tech leaders “have a duty to be honest”: AI could wipe out half of all entry-level white collar jobs and drive unemployment.

Washington in his rearview mirror. Elon Musk’s time at the Department of Government Efficiency is officially up — just in time for him to refocus on a struggling Tesla.

A YU-turn. Chinese electronics giant Xiaomi is outselling Tesla in China’s important sedan market, and Xiaomi just unveiled the YU7 SUV, which will start rolling out soon.

Nothing but “Blue Sky” ahead. United Airlines will return to JFK Airport — once again — through a full-blown partnership with JetBlue.

Mining for political capital. Vice President JD Vance wants the Bitcoin community, which played a big role in the last election cycle, to continue to get involved in politics.

The Rhode to $1 billion. Hailey Bieber’s trendy cosmetics brand, Rhode, just sold to e.l.f for $1 billion, the cosmetic giant’s largest acquisition.

Chipped, not cracked

Most companies would stumble after losing $8 billion in potential sales. Nvidia barely blinked.

In the tech giant’s fiscal first quarter, U.S. export controls wiped out billions in China-bound orders for Nvidia’s H20 chips. CFO Colette Kress confirmed the hit: “Had the export controls not occurred, we would have had orders of about $8 billion.” That hit was more than rival AMD’s entire quarterly revenue.

But Nvidia keeps churning out incredible top-line numbers because its engine is running on far more than China. Revenue soared 69% year-over-year to $44.1 billion, with net income and data center sales rising even faster.

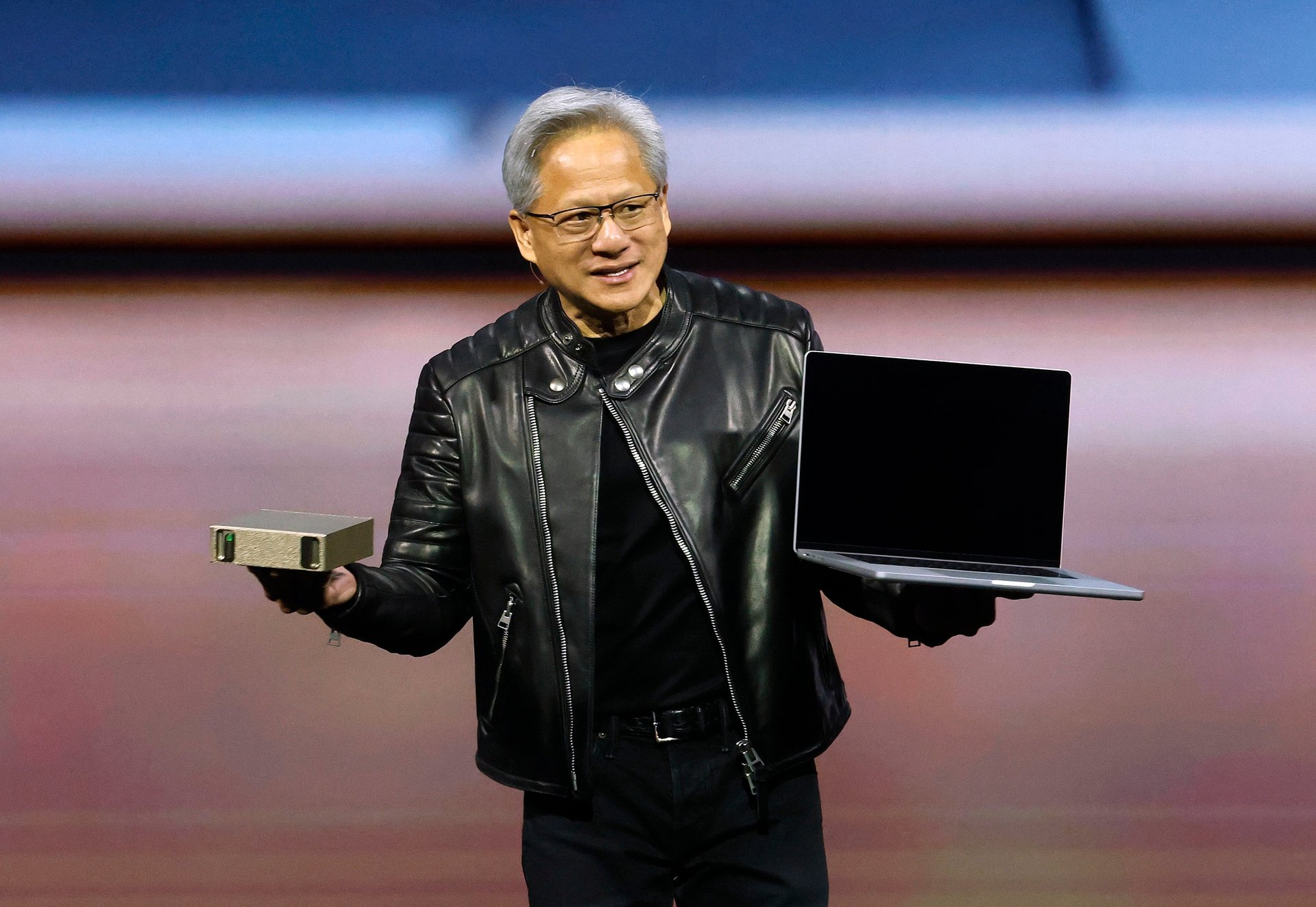

So Nvidia isn’t sweating China too much — it has bigger chips to fry. “This is the start of a powerful new wave of growth,” CEO Jensen Huang said. That wave is global. And by “wave,” he might mean “tsunami”: sovereign AI, agentic systems, industrial robotics, and global infrastructure plays that go way beyond Silicon Valley.

Even as Nvidia eyes a revised Blackwell chip for China, the company is betting big on sovereign AI — because, Huang said, “nations are investing in AI infrastructure like they once did for electricity and internet.” The shift from generative AI to reasoning AI and agentic AI — capable of reasoning, planning, and acting — demands dramatically more computing power. And Nvidia wants to supply all of it.

Sure, Nvidia lost billions in China. But it’s making the case that its real market is much, much bigger. Quartz’s Shannon Carroll has more on the geopolitical chess game Nvidia’s playing in 4D.

Rotten to the core?

As Big Tech races into the AI era, Apple risks being left behind. And soon, the so-called “Magnificent Seven” might be more like a “Magnificent Six.”

While Apple’s Mag 7 peers — Microsoft, Google, Meta, Amazon, Nvidia, and Tesla — have reoriented around AI, Apple has moved cautiously. Its Apple Intelligence suite, powered in part by ChatGPT, arrived late, with limited rollout and few unique features. Apple’s other big swing, the Vision Pro headset, fell short of expectations with sluggish sales and waning developer interest.

Apple’s stock is down around 18% this year, making it the worst performer among the Mag 7. Meanwhile, Nvidia has become the market darling, Microsoft is at the forefront of the next AI developments, and Meta is pivoting from the metaverse to machine learning.

Wall Street still cares about Apple — it remains wildly profitable — but the company is no longer setting the tempo. Add to that slumping iPhone sales in China, tariff threats from Trump, and a Services business that’s growing too slowly to pick up any slack, and the Cupertino giant suddenly looks a little… small.

Yes, Apple still owns the high-end device market. But in a moment defined by bold bets and rapid AI reinvention, merely keeping pace may not be enough. Quartz’s Shannon Carroll has more on an innovator becoming evolutionary, not revolutionary.