🌏 Dimon isn’t cashing out

Plus: Stall Wars.

Good morning, Quartz readers!

Suggested Reading

Here’s what you need to know

Fed’s not feeling it — yet. Fed Governor Christopher Waller said fleeting inflation because of tariffs could potentially lead to “good news” interest rate cuts by the central bank.

Related Content

Cracks in the foundation. After more than two years, the American housing market, which had seemed unstoppable, is finally showing signs that it’s cracking.

Mad Men meet machine. Meta is aiming to completely automate its advertising — images, video, text, and targeted use — with AI by the end of next year.

Disney’s not-so-magic kingdom. The company laid off several hundred employees (mostly based in Los Angeles) on Monday as part of its continued restructuring.

Hands are off the wheel. Elon Musk, who announced that he’s stepping back from his role in the Trump administration, says he’s not the one to blame for everything the president is doing.

A Musk-lose situation. New Jersey’s highway authority booted Tesla chargers off its turnpike in favor of a service-area operator, and Musk is crying “corruption.”

Neural rivals are plugging in. Paradromics, Neuralink’s biggest U.S. competitor, is the latest company to test a brain implant in a person.

Terminal velocity. Newark Airport has reopened an under-construction runway that contributed to recent chaos, as United works to lure customers back to the gate with lower prices.

Brace for market impact. Recessions are part of the economic cycle — here’s how one starts, what a recession truly is, how it can affect you, and when you’ll know that it’s over.

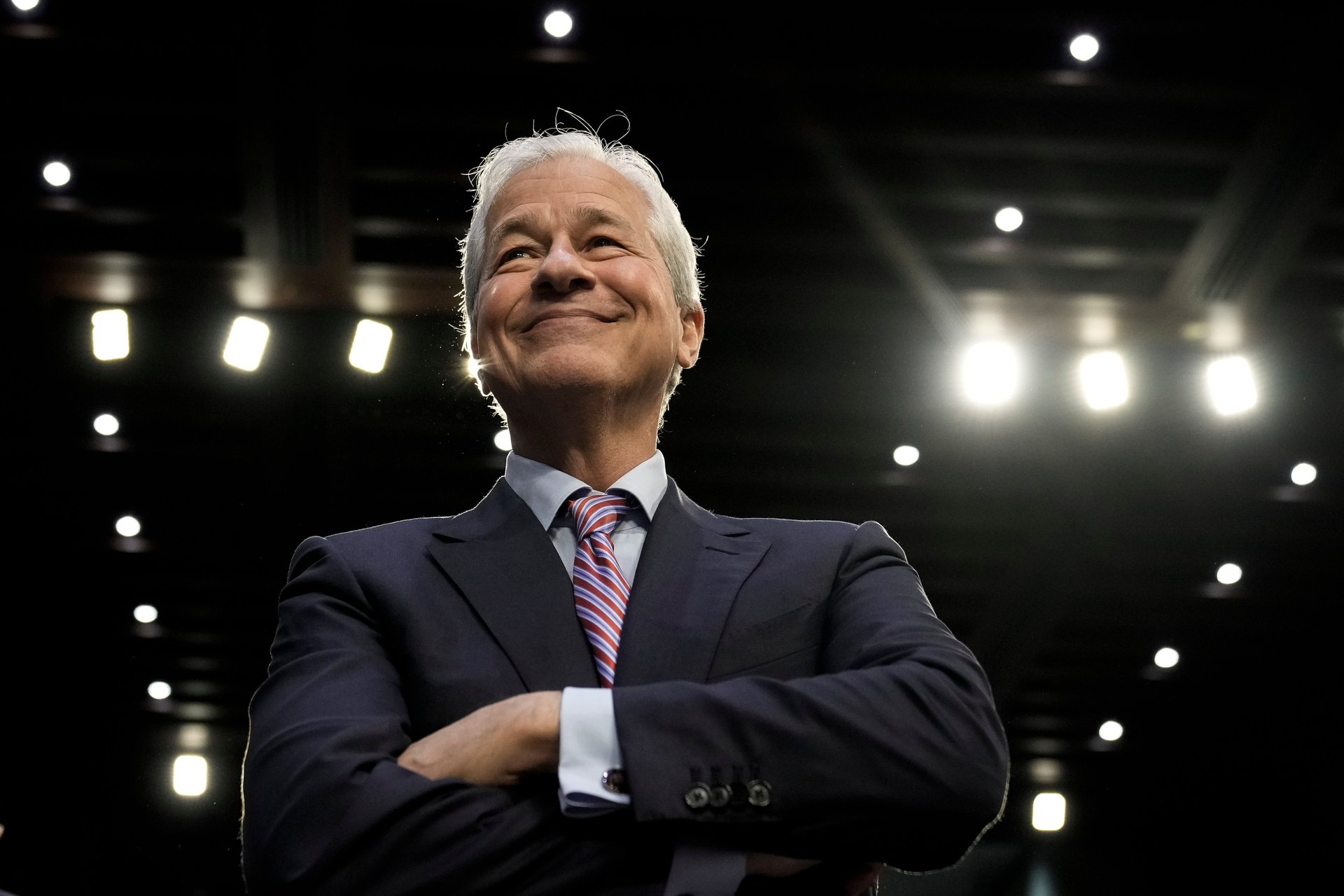

Still bankin’ on Jamie

Jamie Dimon isn’t stepping down just yet. On Monday, the longtime JPMorgan Chase CEO said his departure is still “several years away” — despite saying last year he’d likely retire within five years. In the meantime, he’s keeping the door open to a post-CEO role as executive chairman.

“I love what I do. I love my country,” Dimon told Fox News, before adding that his fate lies with “God and the board.” That may not be JPMorgan’s official governance structure, but after nearly 20 years at the helm, Dimon’s word still carries considerable weight.

Dimon has led JPMorgan through a financial crisis, economic recoveries, and several reinventions, with the bank’s stock rising more than 500% since he became CEO in 2006. A leadership reshuffle in January gave increased responsibility to several potential successors — but none appear poised to take the baton just yet.

Dimon also used the interview to sound a familiar alarm: that rising U.S. debt could roil bond markets and widen credit spreads. “That includes small businesses, high-yield debt, real estate loans,” he said. “That’s why you should worry about volatility.”

For now, Dimon’s staying right where he is — watching markets, steering the bank, and holding onto the top job a little bit longer. Quartz’s Joseph Zeballos-Roig has more on the JPMorgan Chase CEO’s long goodbye.

Truce or dare

The fragile U.S.–China tariff truce may be wearing thin. Over the weekend, China’s Ministry of Commerce accused the U.S. of “undermining China’s interests” and threatened “forceful measures” in response — a notable departure from the cautiously cooperative tone struck just a few weeks ago.

The shift came after President Donald Trump claimed China had violated the recent Geneva agreement, which paused tit-for-tat tariffs in a surprise May détente. China responded by insisting it had “strictly implemented” the deal and implied the real problem is Washington’s mixed signals.

And those signals are getting blurrier. Treasury Secretary Scott Bessent admitted last week that talks are “a bit stalled” and said progress may depend on a call between Trump and Chinese President Xi Jinping. Meanwhile, a federal appeals court has issued a temporary stay on a ruling that said parts of Trump’s original tariff plan may have been unlawful, allowing those duties to remain — for now.

Now, boardrooms are bracing... again. A Conference Board survey found that 83% of U.S. CEOs expect a recession within the next 18 months, and markets seem to agree. On Monday morning, Nasdaq and the S&P both slipped, while gold and the VIX spiked — textbook signs of fear and flight. Quartz’s Catherine Baab has more on the art of not quite dealing.