Goldman’s bet on trading is paying off

Goldman Sachs posted first-quarter results today.

The numbers: Profit rose 40%, to $2.84 billion in the first quarter, from $2.03 billion the year before. Revenue also rose 14%, to $10.62 billion.

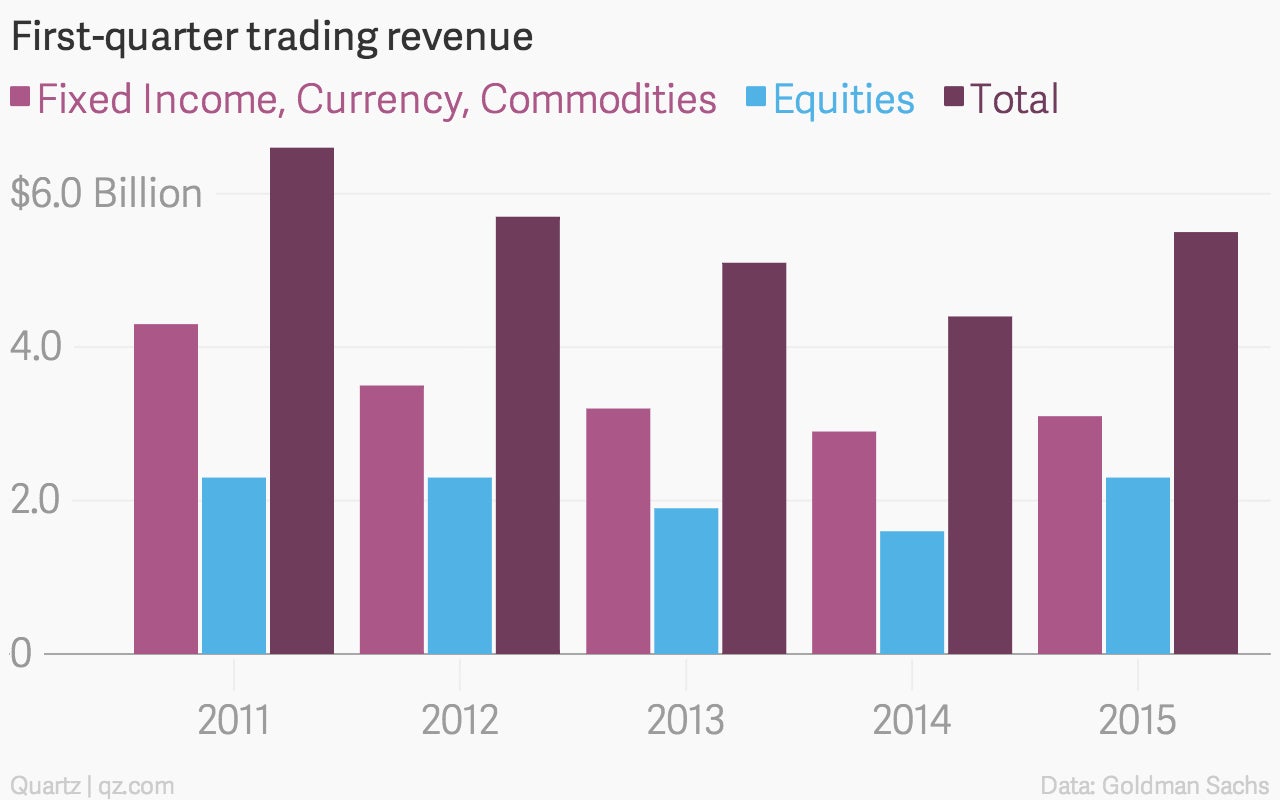

The takeaway: Goldman’s decision to stay the course with its trading business as its rivals retreated from the volatile area (paywall) has paid off in a big way. Trading revenue at the bank surged by 23%, to $5.46 billion, helped by a 10% increase in revenue from fixed income, currency, and commodities and a massive 46% jump in equities trading revenue.

What’s interesting: Goldman’s success with its trading business seems to be teaching Wall Street an important lesson about the perils of listening to bank analysts.

“Is the long-term strategy that we’ve all been beating you up for for the last five years working?,” one analyst asked Goldman CFO Harvey Schwartz on the first-quarter earnings call.

Schwartz’s response: “While you’ve been beating us up, we’ve been focused on what clients want.”